FSW – Compatible with Mazda Cx-60 2022 On Fully

FSW – Compatible with Mazda Cx-60 2022 On Fully Tailored Car Floor Mats – 5mm Extra Heavy Duty Rubber – Anti Slip Mat – Fully Waterproof – Hard Wearing – 4 Piece Set Floor Mats Only

- TAILORED TO BE COMPATIBLE WITH CAR MATS: Extra heavy-duty 5mm rubber car floor mats, tailored to be compatible with the Mazda Cx-60 2022 On. Precision laser-cut to perfectly match your vehicle's contours perfectly. This 4 piece set provides robust protection with a 5mm thickness, engineered to safeguard your vehicle’s floor from damage.

- WATERPROOF & REINFORCED RUBBER: Our car mats feature a sleek design and complement your car interior with modern reinforced rubber. We have manufactured this 4 piece set with a multi-layered construction made out of a hard-wearing rubber compound that will last through all seasons. Unlike universal mats, FSW's heavy-duty rubber mats are custom-designed for a precise fit in your car

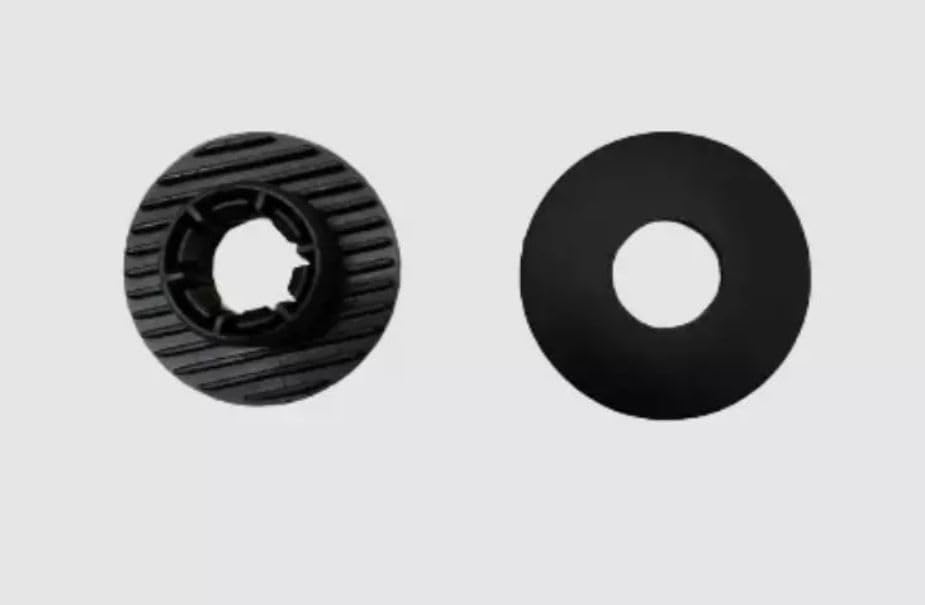

- FITTING CLIPS FOR SAFETY: Fitted with an anti slip backing and clip fastening, you can be assured that these mats will stay put in the footwell area. Each mat is designed for convenience, featuring anti-slip backing that locks it securely in place. The 4 clips included are easy to install and fasten the carpet effectively for added security

- PROTECT THE INTERIOR OF YOUR VEHICLE: Professionally cut for a highly durable and perfect fitting 5mm extra heavy duty rubber mat set to protect the flooring of your car. Supplied in hardwearing black rubber with non-slip backing this mat set will look fantastic whilst not compromising on protection from mud and spillages. Made from extra-durable rubber, these mats are incredibly easy to clean. A quick spray with a garden hose will have them looking like new

- FIRST STOP WHOLESALE: We are a manufacturing company based in Yorkshire which specialises in manufacturing tailored to fit, ready made and safe fastening car mats and seat covers over a range of models. Each car mat is cut using the latest CAD technology ensuring a tailored fit. Our car floor mats are available in a number of different material qualities and colours. Choose between 3 types of our car mats: a 4-5mm carpet, a 3 mm rubber and a 5mm heavy duty rubber material

Based in Yorkshire, we manufacture tailored car mats and seat covers. Each mat is precision-cut with CAD technology for a perfect fit. Choose from 4-5mm carpet, 3mm rubber, or 5mm heavy-duty rubber in various colours. First Stop Wholesalers has brought a tailored carpet car mat set compatible with the Kia Soul Electric Vehicle 2020 On. This 4-piece set features a durable 500gsm black carpet for high-quality, smart-fitting car mats. The granulated backing provides an anti-slip grip, protecting your car’s footwells. Invest in these premium mats to enhance your vehicle’s interior and ensure maximum convenience. Please compare the image of the mats to your car floor area as the same vehicle can have different mats and clips

| SKU: | B0DG8Q2SYP |

| Brand: | FSW |

| Manufacture: | FSW |